State of play: graphing the Australian games industry

Interactive entertainment, including games, should be supported by an offset scheme and funding to entice the production of content

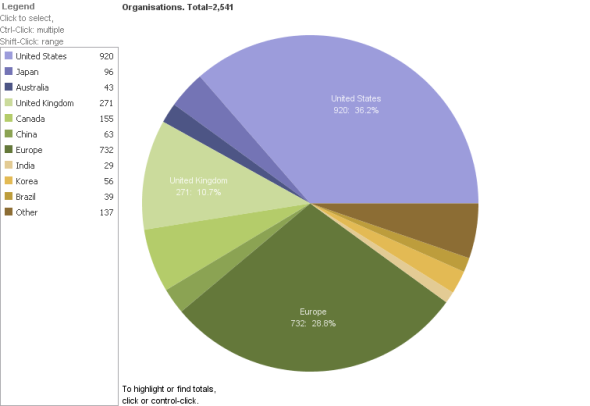

Australia is on the frontier of a multi-billion dollar internationally recognised games industry, with the economic importance of interactive media and games set to increase with the growth of games that are more and more commonly used for entertainment and education. In the early 1980’s, Australia’s games industry emerged internationally with the transition from arcades to consoles and home computers providing the current industry with an impressive 30 year history of growth as development studios opened across the nation. While Australia is home to only 43 of the 2541 (1.7 per cent) of game organisations worldwide, as of 2011, the industry is worth $1.5 billion (PWC, 2012) of the $64 billion global industry (2.3 per cent) (Reuters, 2011).

International location of game development organisations (Source: gamedevmap.com, 2012)

As the game industry undertakes another transition from consoles and handhelds to mobile games and interactive media, the annual value of the Australian interactive games industry is forecast to rise from the current $1.5 billion to $2.2 billion by 2012 (The NPD Group Australia, PricewaterhouseCoopers).

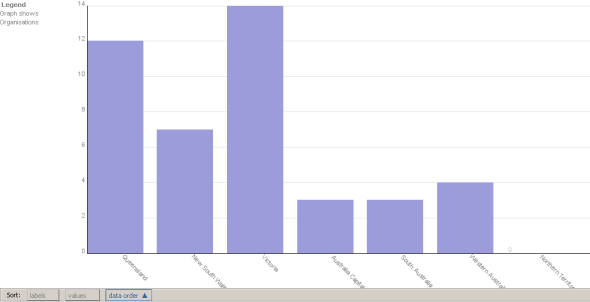

These increases are predicted to occur despite the closures of major pioneer game development studios in Australia including Pandemic (2009) and Krome (2010) in Brisbane, and THQ (2011) in Brisbane and Melbourne. Regardless of these closures, the Victorian and Queensland industry still remain significantly stronger than other Australian states with numerous studios still operating in Brisbane and Melbourne.

Game development organisations in Australia. (Data sourced from gamedevmap.com, 2012)

In March 2012, the Australian Government released its Convergence Review of media and communications across Australia. The findings showed that interactive entertainment, including games, should be supported by an offset scheme and funding to entice the production of content.

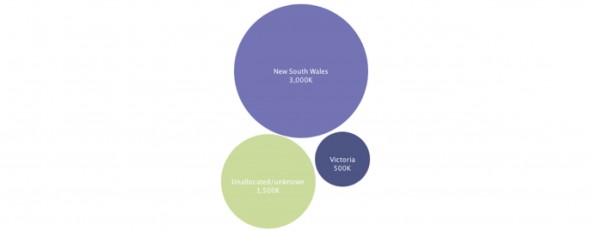

Through Screen Australia, up to $5 million in funding was allocated in 2010-11 for innovative screen content. From this funding, Film Victoria has allocated $500, 000 for game development and Screen NSW has invested $3 million to an Interactive Media Fund to develop it’s digital economy. However, Screen Queensland does not provide funding support for game or interactive media development.

Australian Goverment game development funding distribution by state (2010-13)

Queensland is a rich hub for game developers, many of which have built an international reputation for their skills, however the 2012-13 state budget delivered by the Queensland Government on 11 September 2012 once again fails to recognise the success of this flourishing sector.

With no indicative funding allocated to assisted the local games industry in the Queensland Government’s 2012-13 budget, it’s not surprising that HalfBrick Studios, a Brisbane based game development business who produced the international smash Fruit Ninja, is set to open a Sydney based office to expand the popular phenomenon with a sequel game, assisted by Screen NSW’s $3 million Interactive Media Fund.

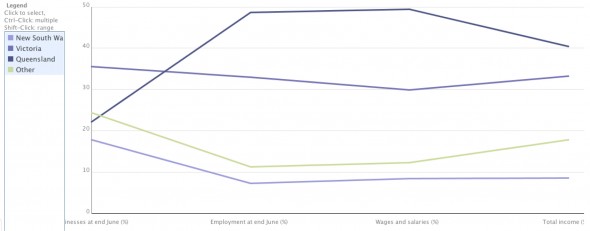

However, the Queensland Government is only too happy to promote it’s success on their website, boasting that the Queensland game development industry represents 40.4 per cent of the Australian gaming industry, employs 700 people, is home to 48.6 per cent of Australian’s games developers and made A$55.4 million of Australia’s A$136.9 million earning in the 2007-08 financial year.

This data is based on the Australian Bureau of Statistics review of Digital Game Development Services in 2006-07, which shows Queensland as the front runner of the game development industry in terms of the number of businesses, employment figures, wages and salary, and total income.

Australia’s digital game development services 2006-07

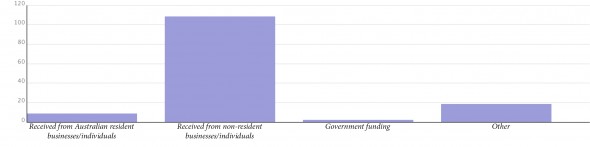

The Australian Bureau of Statistics also shows how the $139.5 million in income from 2006-07 is generated, with only 1.7 per cent coming from government funding, and an overwhelming 79.1 per cent ($108.3 million) coming from overseas sources.

Income of Australia’s digital game development services (2006-07)

So, where to from here?

The Convergence Review found that “interactive media is increasingly becoming more a significant part of our cultural and creative production and will therefore play a more important role in expressing our cultural identity”(Australian Government Convergence Review, 2012).

The way in which Australia continues to produce interactive media will change as people shift from single-screen consumption to multiscreen (mobiles, television, PCs, tablets etc) games become more popular forms of entertainment and education (Australian Government Convergence Review, 2012).

In fact, the Interactive Games & Entertainment Association recently published a research report called Digital Australia 2012 conducted by Bond University to evaluate Australia’s digital media ecology in households. The key findings show a significant increase of parents who play games with their children for educational purposes:

- A 13 per cent increase since 2008 of parents living with children aged 18 or under who play computer games.

- Of these parents, 88 percent play games with their children; an increase of 8 per cent since 2008.

- A 15 per cent increase from 2008 of parents who use games with their children for educational purposes.

Despite the increasing demand for mobile and interactive media, particularly for educational purposes, if only limited funding (or no funding, as is the case in Queensland), is provided to local development studios, Australia’s gaming industry may struggle to meet the impressive annual value forecasts and developers may start turning interstate or internationally for funding assistance, taking away Australia’s economical benefits with them.